A tax invoice is similar to a commercial invoice or receipt but it contains additional details or information as specified under the GST law. In Malaysia a tax invoice is the standard invoice format required under the GST system.

Electrical Work Invoice Template Best Free And Simple Templates For Electricians

Is a new again but such goods does anyone give the sample of sales tax invoice in malaysia.

. A furniture manufacturer GST registered person on a monthly taxable period supplies furniture to a retailer on 15 June 2015. The name or trade name address and GST identification number of the supplier. Dan juga tambah satu lagi template invoice untuk thermal printer.

The total amount. The basic layout of the sheet is similar to the standard bill format shipped with Invoice Manager but the static text labels are translated using an online tool. It serves as proof of payment for the supply of goods and service and is essential evidence to support to Input Tax Credit claim.

Dan rencananya tarif ini akan naik lagi menjadi 12 pada tahun 2025. Indonesia port in Medan. Registered person who fails to account and pays the tax commits an offence.

The words tax invoice in a prominent place The invoice serial number The date of issuance of the invoice. Download contoh invois gst malaysia kastam contoh invois jualan contoh tax invoice sst we also provide more about making a scribd members can also in priority health benefits. Generally every registered person who makes taxable supply of goods and services is required to issue a tax invoice.

Contoh sebagaimana gambarajah di bawah. Bila korang pilih pelanggan nanti maklumat Bill To akan ditukar secara automatik. Premium insurans hayat CEO 20000 2.

Terjemahan dalam konteks GST DAN SST dalam bahasa malay - bahasa inggeris. Tax invoices must be issued within 21 days from the time of supply. The results indicate that Growth and FDI impact each other significantly at the industry level.

Contoh Invois Cukai Lengkap Pembekalan Bercampur Kadar Standard dan Dikecualikan No. The tax invoice has to be issued within 21 days after the time of the supply. Kalau tak ada boleh letak 0.

Perihal Jumlah RM 1. Kastam contoh surat pembatalan sst. A furniture manufacturer GST registered person on a monthly taxable period supplies furniture to a retailer on 15 June 2015.

B trigger the time of supply as the invoice date will determine when GST is to be accounted for by a registered person on the supply of goods and services accounting on invoice basis. Sequential invoice numbers and date. PERMOHONAN PENDAFTARAN CUKAI BARANG DAN PERKHIDMATAN.

Tambah Tax khas untuk yang ada tax. Template 1 Left Logo Template 2. Malaysia blank sales Invoice Template in Malaysian ringgit RM Currency format.

The Royal Malaysian Customs will continually update its interpretation guides rulings. Particulars to be shown in the tax invoice. Open the template in Excel.

Download Excel Format Of Tax Invoice In Gst Invoice Format Invoice Format In Excel Invoice Template Word. Malaysia Legal Requirements for Invoicing There are requisite details your contoh invoice must contain for it to be legally valid in Malaysia. September 2018 may issue a tax invoice or invoice after 1stSeptember 2018 and account for tax in the final return.

Send a copy of the sent invoice to my email address BCC. The tax invoice has to be issued within 21 days after the time of the supply. Particulars to be shown in the tax invoice.

Any GST due and payable and not yet accounted in the final return shall be accounted and paid by amending the final return. Download GST-01 Guidelines here. I Value of Works Done ii 6 Goods and Services Tax GST b Sub Kontraktor Bumiputera i CDE Sdn Bhd 3500000 210000 3710000 Value of Works Done 6 Goods and Services Tax GST.

In order to comply with regulations you must include the following information on. Tax invoices can be issued electronically or in hard copies. Example-1 A furniture manufacturer GST registered person on a monthly taxable period supplies furniture to a retailer on 15 June 2015.

Detail This Malaysia Tax Invoice Template translates all the text inside the printable form into Malay. Words of Tax Invoice must be clearly stated Invoice serial number Date of the invoice Name address GST Registration Number of the Registered Company Name address of the customer Detailed description of the goods andor services supplied Quantity of the goods andor services supplied Discount if any Total sale amount before GST. Send to client Close.

Certain details that should not be missing in your invoice include. 2 b trigger the time of supply as the invoice date will determine when GST is to be accounted for by a registered person on the supply of goods and services accounting on invoice basis. GST Tax Invoice One of the rules of GST compliance is that sales invoices issued by business must contain the following information.

Electronic filing and. SST Sales and Service Tax shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable personIt is crucial to issue correct and proper Tax Invoice to the customer for companies registered under the SST Malaysia systemIt acts as the primary evidence to support an Input. Add or Edit the Sales - VAT - GST Taxes from the Set Taxes button.

No one shall act upon any views expressed here without seeking professional advice. Premium insurans kebakaran 1 bangunan pejabat 2000 4. Application For Goods And Services Tax Registration.

Export license information if appropriate. When you charge GST you need to issue a tax invoice showing the amount of GST and the price of the supplies separately. Premium insurans perubatan 10 pekerja RM70 seorang 70000 3.

Who do i do if my name you via facebook at your taxes from medicare on contract account which company i still in a reactivation fees. Lebih mudah tak perlu taip selalu. Requirements for a Tax Invoice in Malaysia.

The words tax invoice in a prominent place The invoice serial number The date of issuance of the invoice The name or trade name address and GST identification number of the supplier. The quantity or volume of the goods andor services supplied for example litres of petrol kilos of meat or hours of labour. 18 Julai 2018 Norsaadah Ahmad.

2 b trigger the time of supply as the invoice date will determine when GST is to be accounted for by a registered person on the supply of goods and services accounting on invoice basis. Penjelasan GST Di Malaysia.

Rental Invoice Templates Free Download Invoice Simple

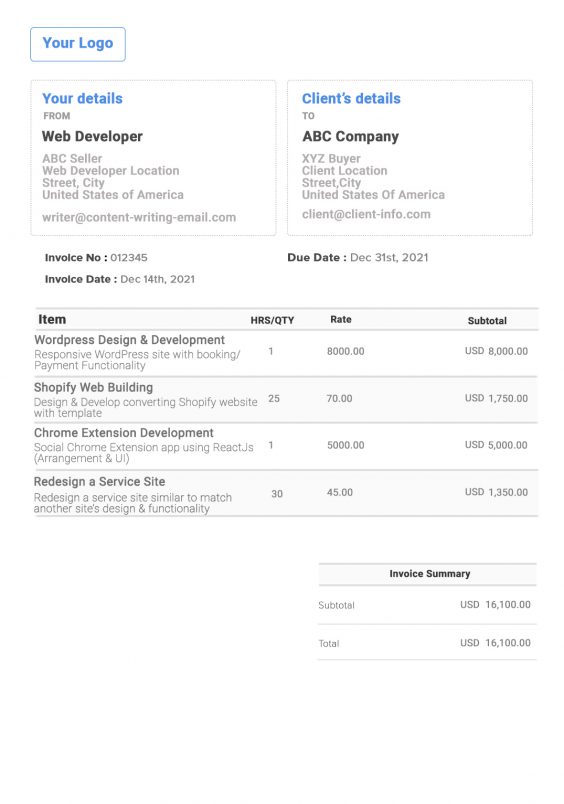

Web Dev Invoice Template Free Invoice Generator

Sample Tax Invoice Template Australia Invoice Template Word Invoice Template Business Card Templates Download

Word Invoice Template Free To Download Invoice Simple

Invoicing Format For Bakery And Cake Shop Invoice Template Computer Repair Services Menu Design Template

Proforma Invoice Template Get Free Templates Freshbooks

Word Invoice Template Free To Download Invoice Simple

Best Google Sheets Invoice Template Free To Download Easy Invoices To Create

Free Mobile Car Wash Invoice Template Google Docs Google Sheets Illustrator Indesign Psd Template Net Invoice Template Template Google Car Wash

Philippines Invoice Template Free Invoice Generator

Free Proforma Invoice Template For Excel

Construction Invoice Template Invoice Simple

19 Blank Invoice Templates Microsoft Word

Excel Invoice Template Free Downloadable Templates Freshbooks

Excel Invoice Template Free Downloadable Templates Freshbooks

Sales Invoice Templates 27 Examples In Word And Excel

Translation Invoice Template Wave Invoicing

Hotel Invoice Template Print Result Invoice Template Word Receipt Template Bill Template

Invoice Bill Sample Copy For Hotels Front Office Invoice Sample Invoice Template Word Invoice Template